America is on the brink of a serious retirement crisis. One in three people are falling dangerously behind in saving for retirement. That means 1/3 of the country is at risk of running out of money, falling into poverty or saddling our children with a crippling financial burden.

The retirement crisis is one of the most pressing social issues of our generation. But it’s also one of the most ignored—a recent study shows that Americans spend more time planning where to go to for dinner than they spend planning for retirement.

To change this, we had to transform the way America thinks and talks about retirement planning.

Case Study: 2015 in Washington DC:

The Washington, DC race was originally scheduled for October 4th. But three days before the race, we had to cancel the event due to Hurricane Joaquin. The race was rescheduled for November 7th. It rained.

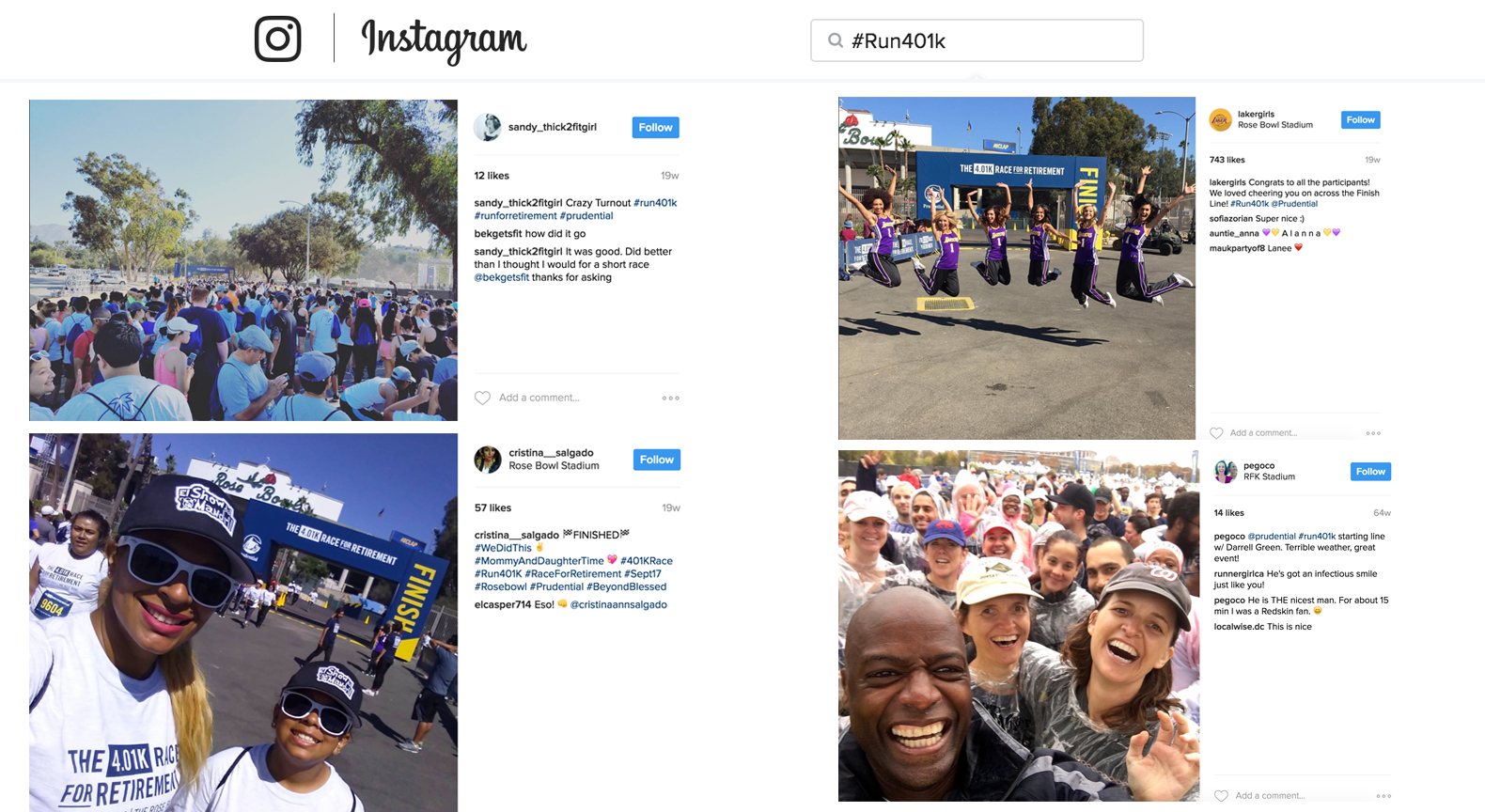

2016 in Los Angeles:

Photo gallery

The Post-Race Festival

One of the biggest barriers to retirement readiness is financial literacy. A recent study by Prudential showed that many Americans lack even the most basic knowledge about personal finance, leaving them totally ill-equipped to plan for retirement.

To change this, we took some of the most complex, tedious and intimidating financial lessons and broke them down—transforming them into a massive festival, with more than 40 games and activities. Here are some of the highlights:

The Longevity Challenge

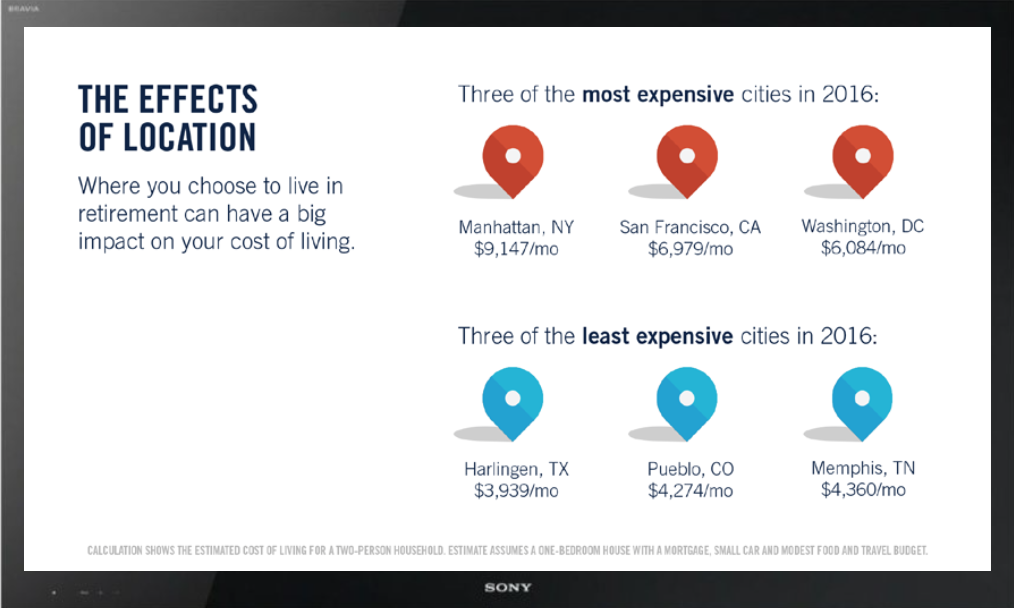

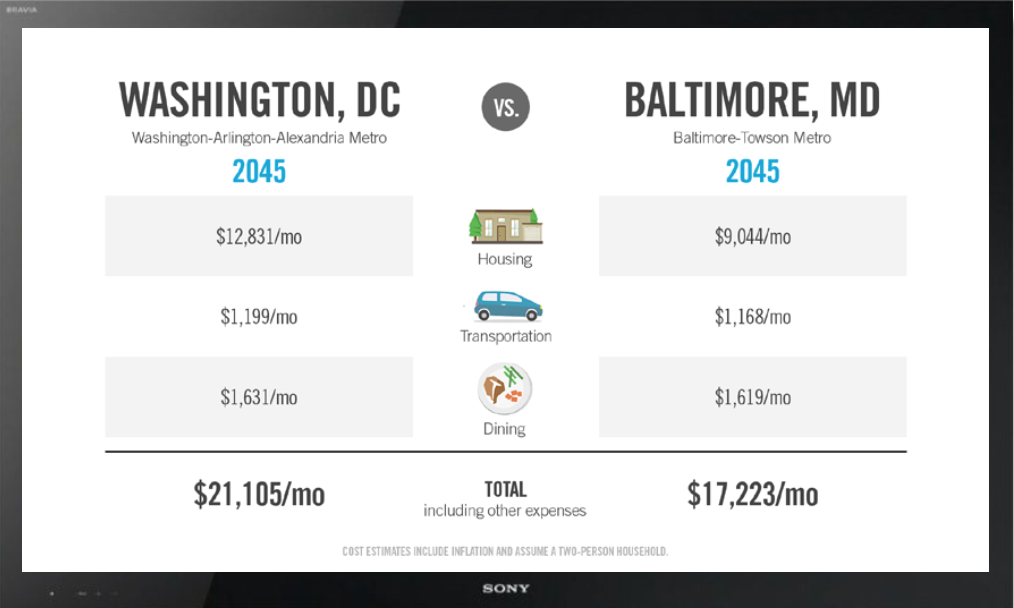

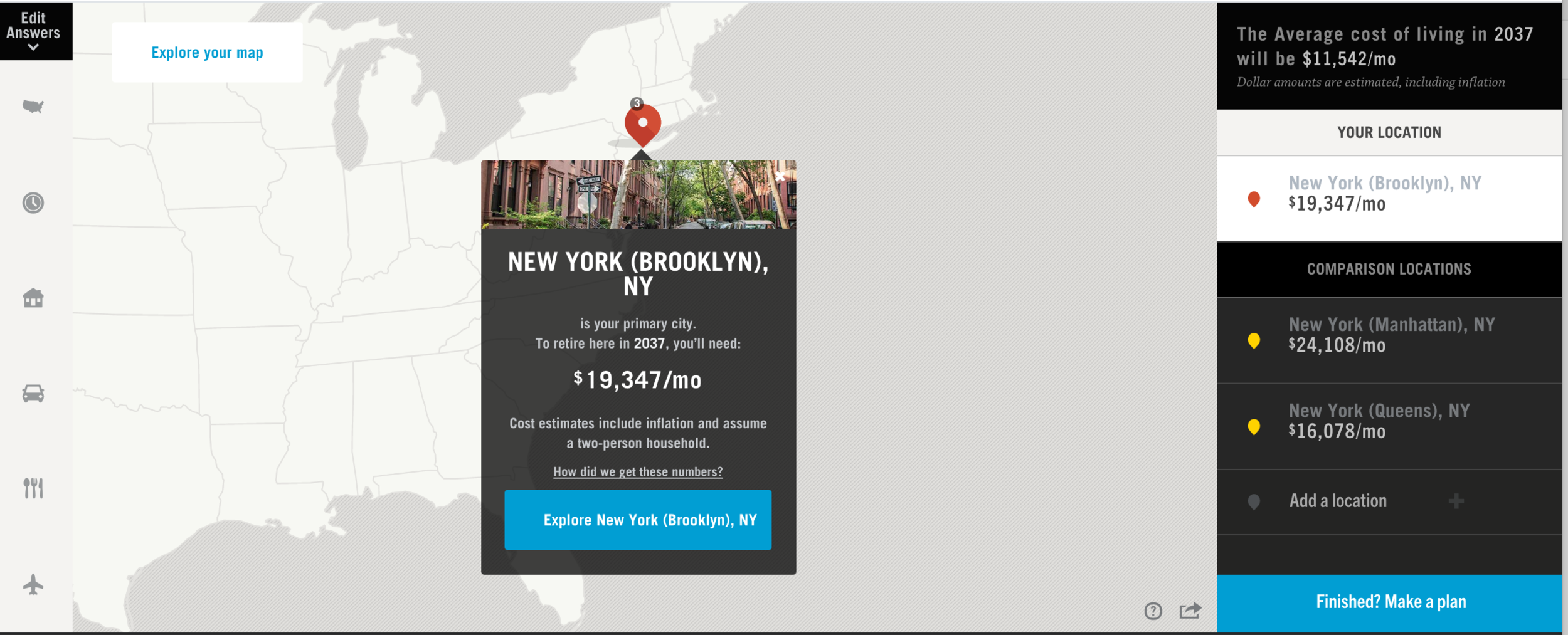

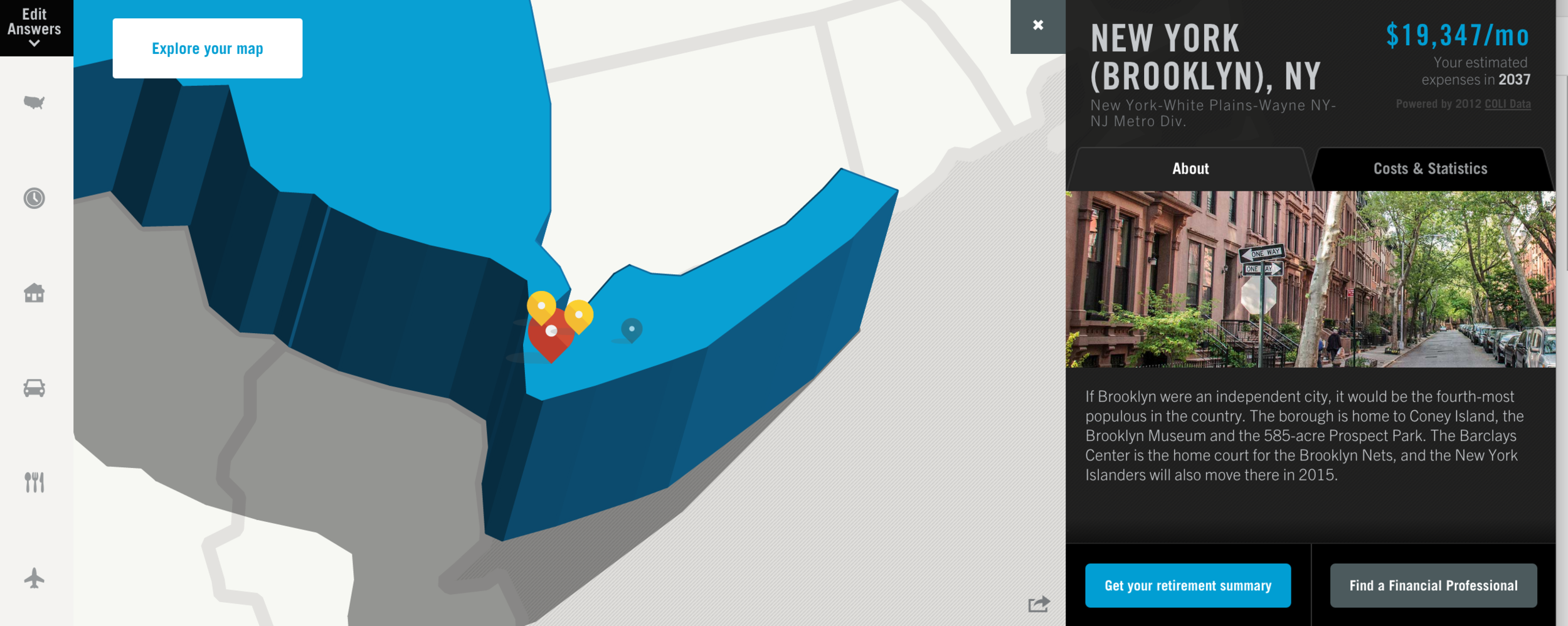

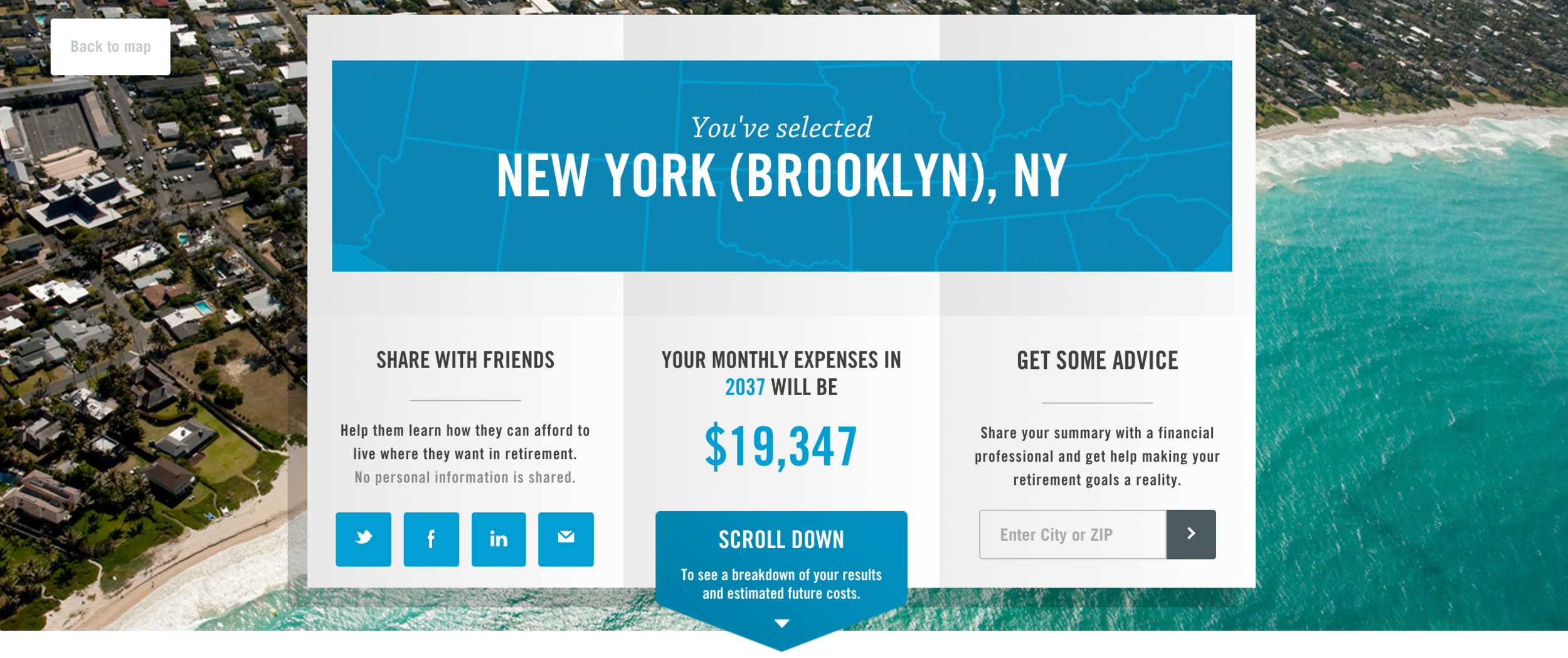

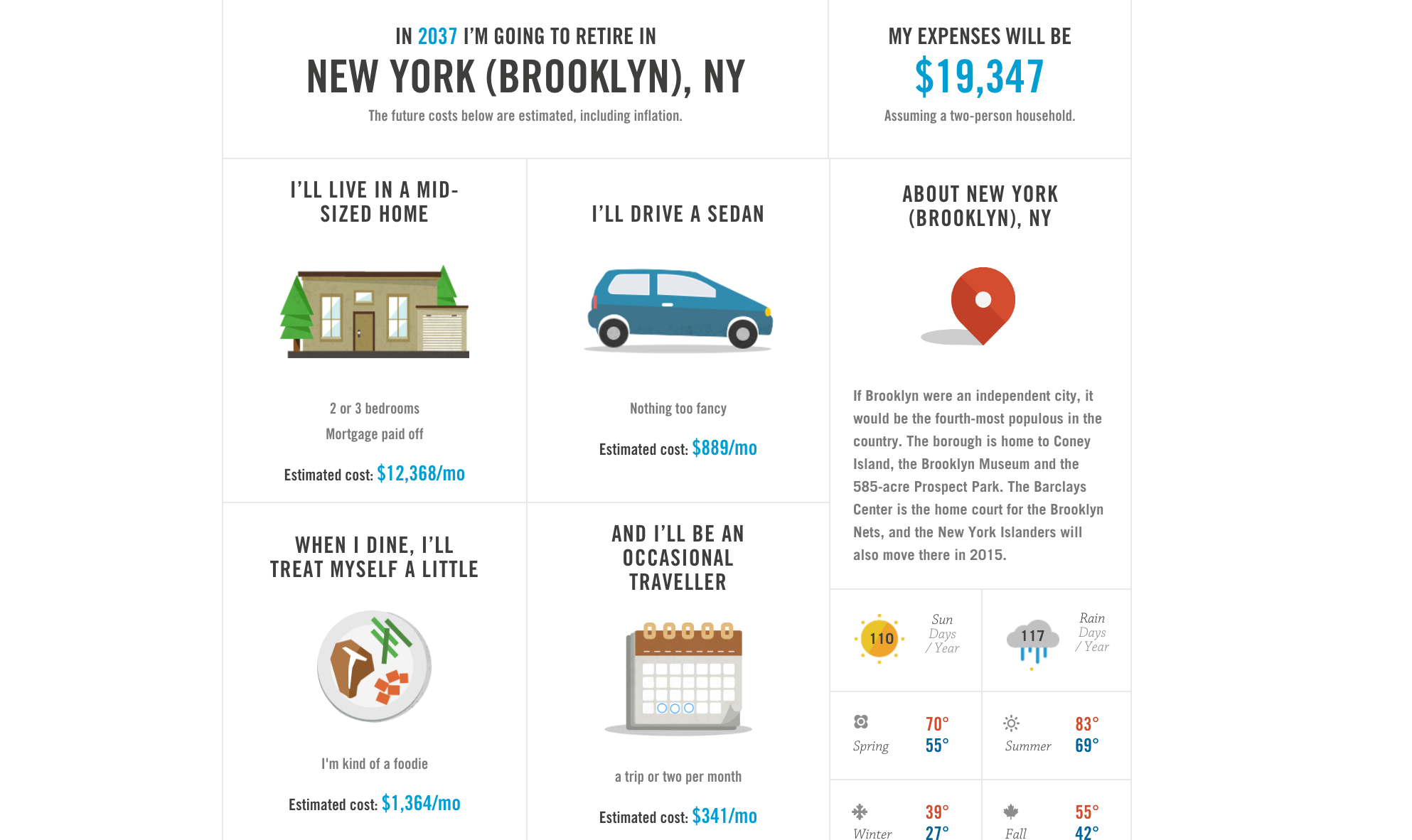

People are living longer. Which means retirement could last for 30 years or more. To get people thinking about just how much money they need to save, we asked them to show us where they want to live in retirement. Then we showed them just how much it will cost to live there. Chances are, it takes a lot more than you might think.

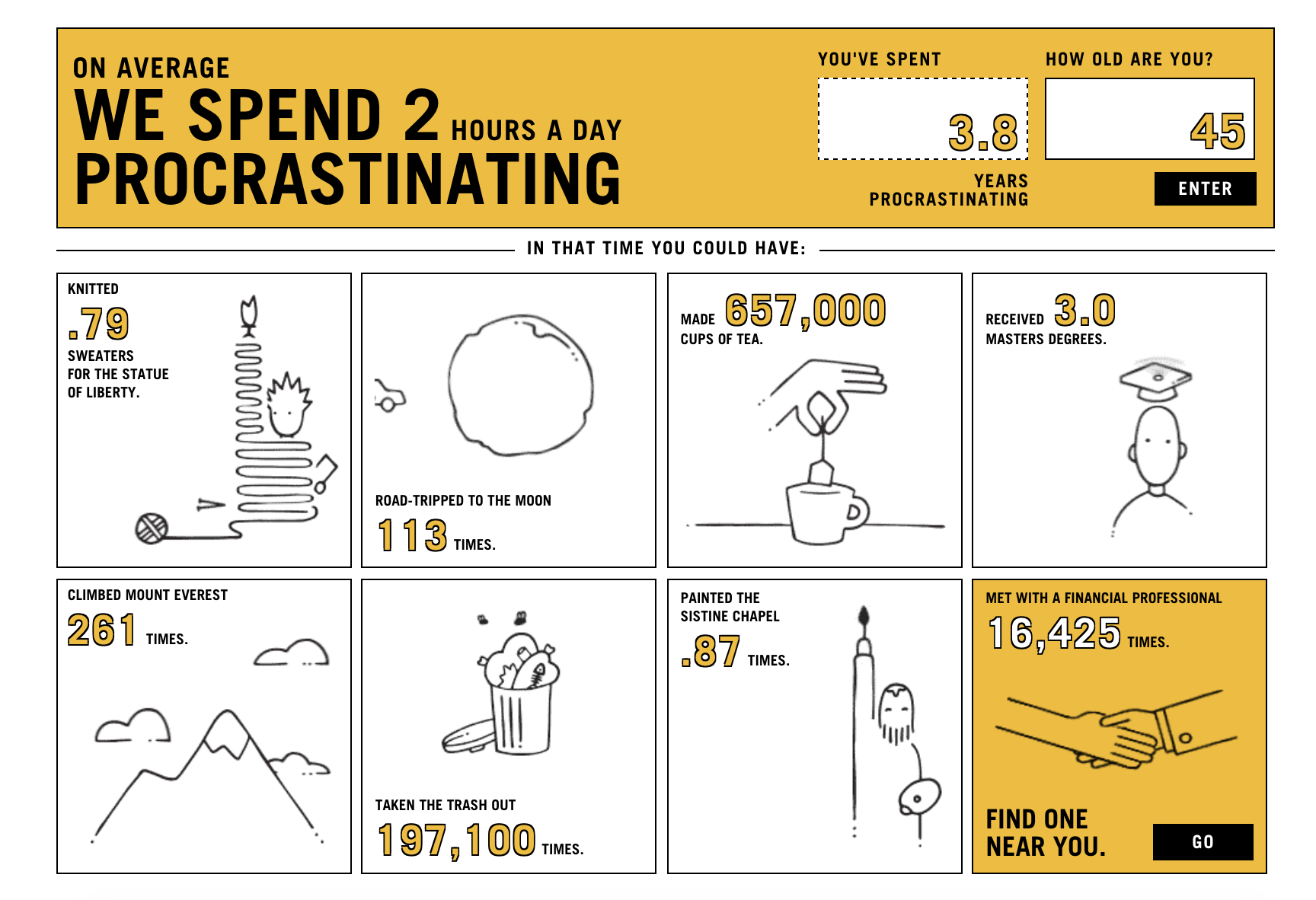

The Procrastination Challenge

A lot of people aren’t saving for retirement because they’re simply putting it off. So we showed people how much time they’ve spent procrastinating, and just how much that can cost them when it comes to saving for retirement.

The Optimism Bias Challenge

Are you more likely to be injured by your toilet, or your toothbrush? A falling coconut, or a bolt of lightning? One of the biggest barriers to planning for the future is that humans are inherently terrible at judging the odds of things happening to us. That's why dedicate far too much energy into worrying about things that probably won't happen (terrorist attacks, burglaries and plane crashes) and not nearly enough energy on things that actually could happen (random workplace injuries, illnesses or car accidents). That strange bias is why we're so bad at preparing for the unexpected—and why 50% of Americans don’t have enough life insurance. To get people thinking about this tendency, we created The Game of Odds. A card game where you try to guess the odds of things happening to you.

The Herd Mentality Challenge

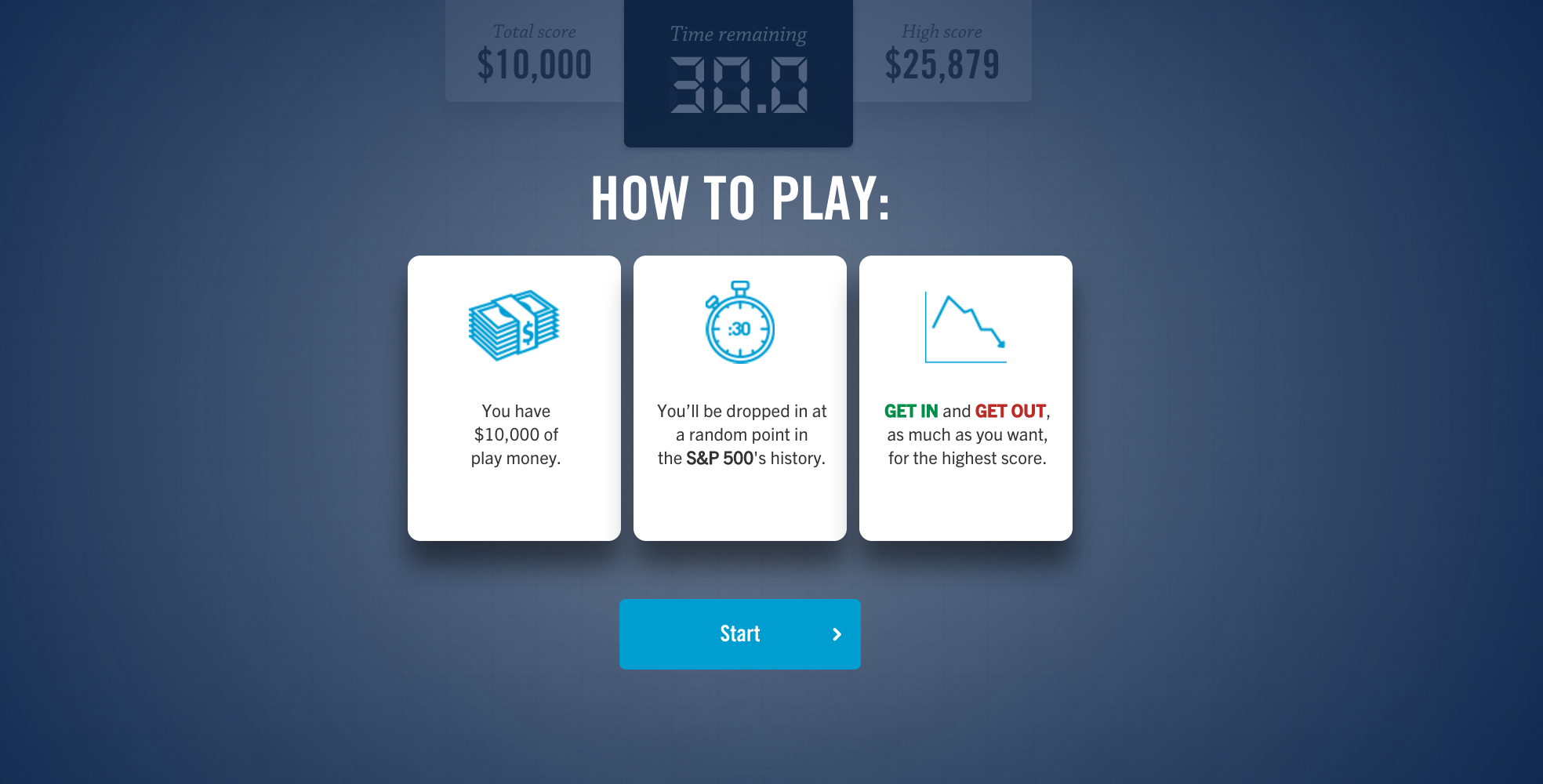

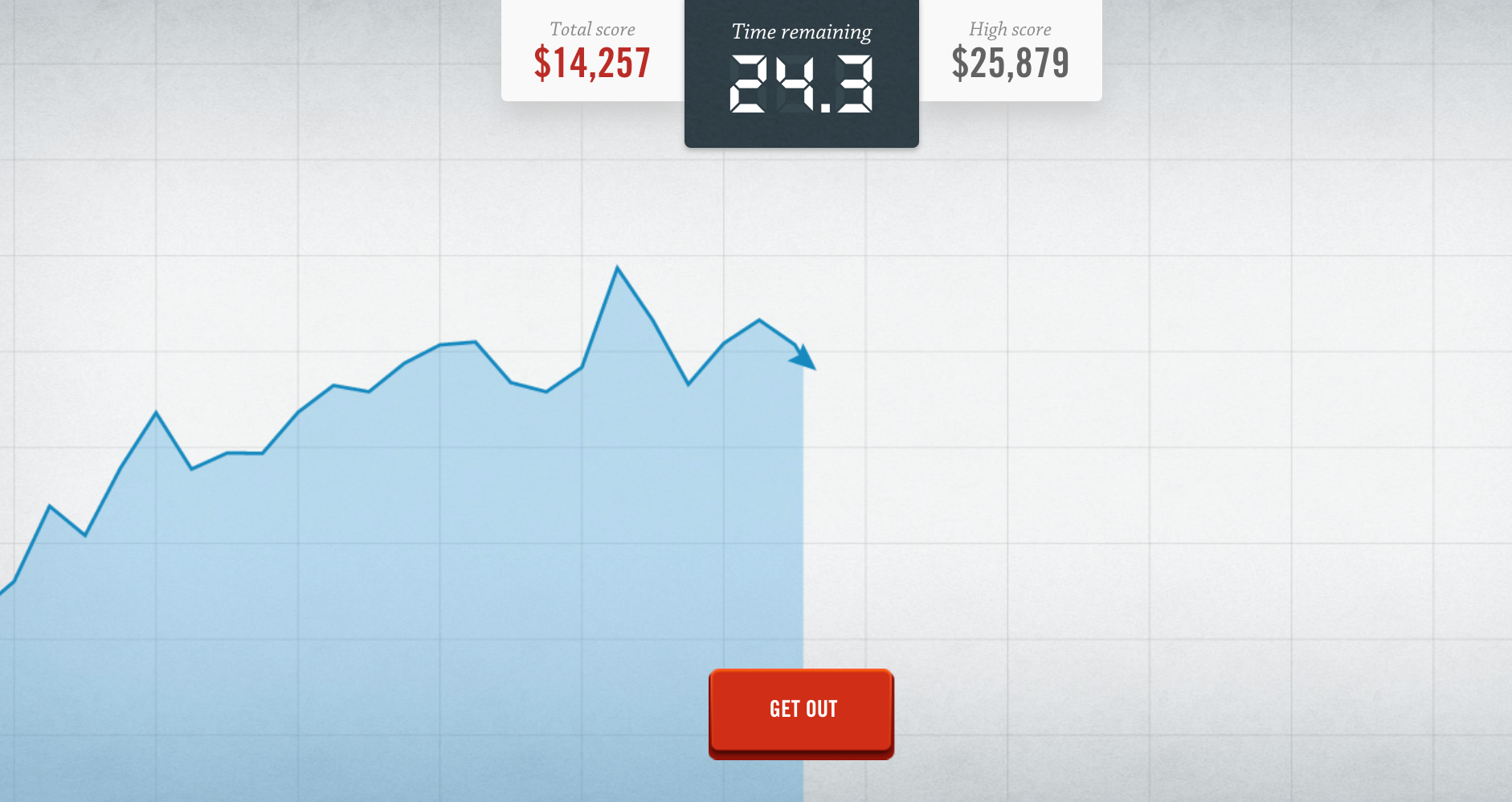

Humans are hardwired to follow the pack. But when it comes to our finances, following the crowd can really hurt our long-term investing goals. When the market tanks, we sell, and when it's going up, we feel confident enough to buy. That's the exact opposite of what we're supposed to do!

To demonstrate this, we created “Outsmart the Market,” a video game where you jump back and forth to jump in and out of the stock market. The lesson: when we try to react to the ups and downs of the market, we rarely come out on top. But if we keep our eye on our long term goals, we’ll be much better off.

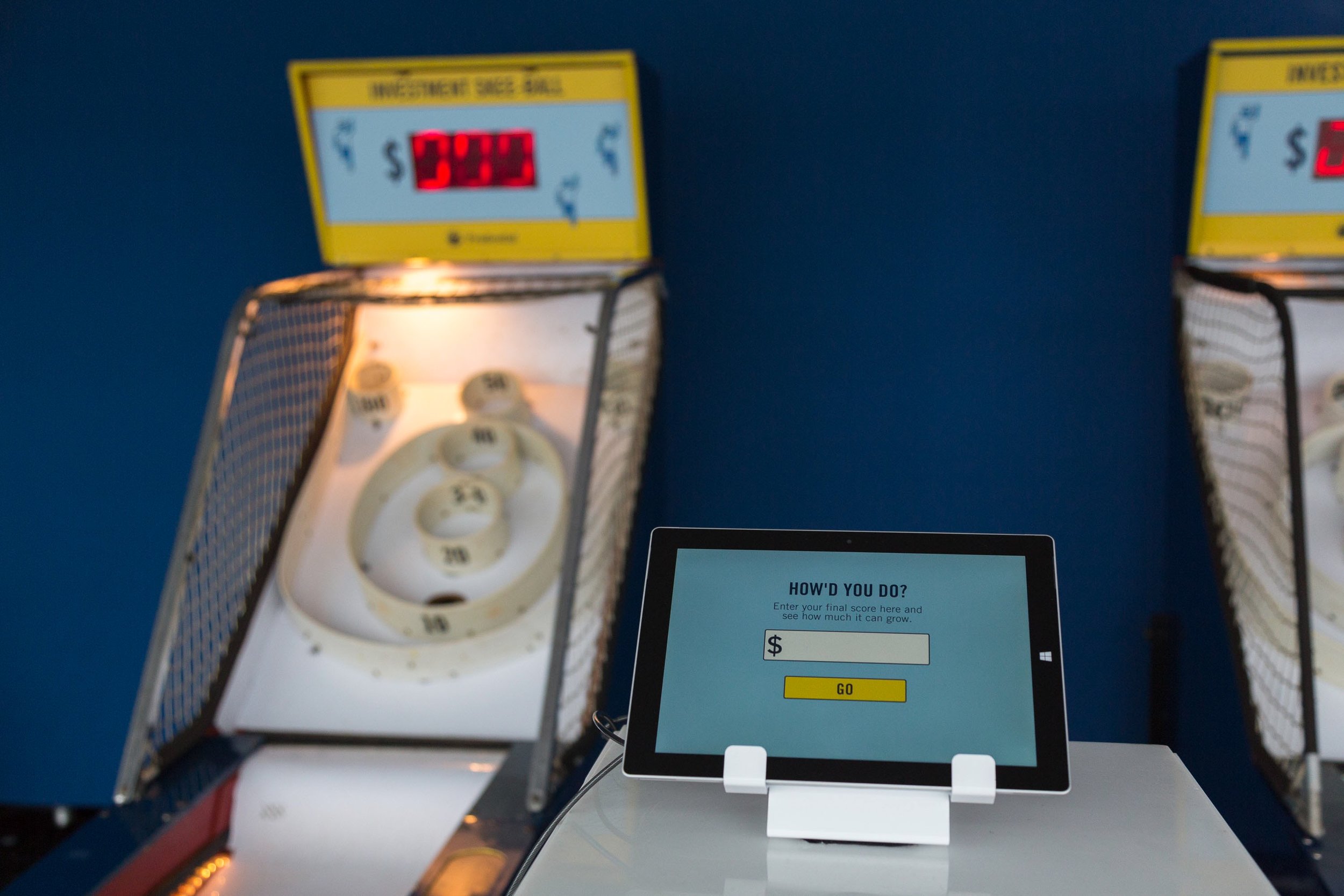

The Instant Gratification Challenge

It’s hard to imagine how something as small as the money in your pocket could make an impact on your retirement. But (thanks to the power of compound interest) if you take some of that money and put it towards your retirement, you can make a surprisingly big difference over time. To demonstrate this, we hacked basketball and skee-ball arcade games and showed people just how much a little bit of money (your final score) can add up when you put it in your 401(k).

Save Today, Love Forever

Pizza. Traveling with your family. Going to the movies. Taco night. The things you love today will always matter—even in retirement. But these things cost money. That’s why it’s so important to start saving now - so you never have to give up the things you love to do.

To get people thinking about that, we created a temporary tattoo parlor, filled with all of our favorite hobbies and interests. Then we and asked everyone to show us the things that are worth saving for.

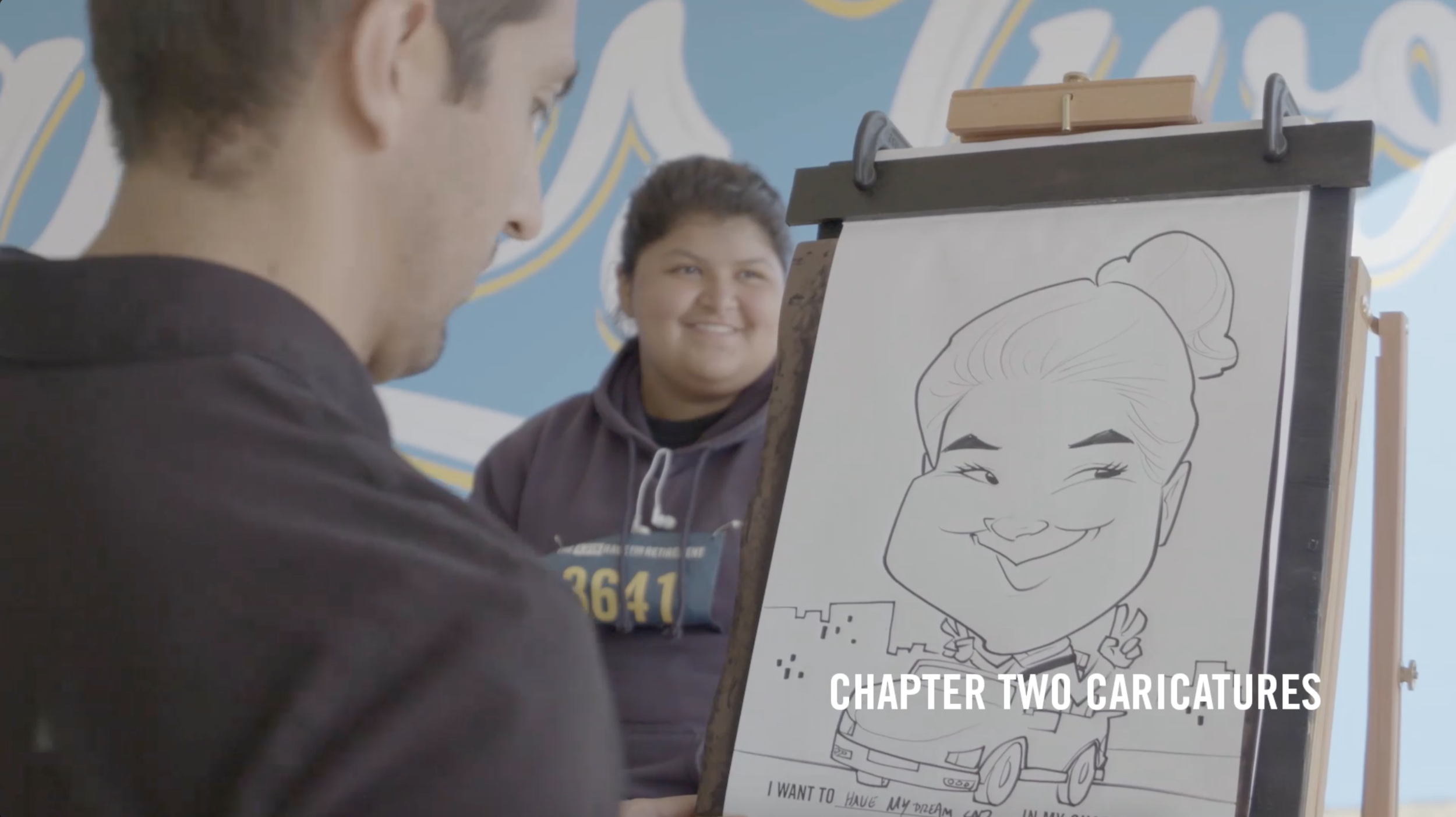

Chapter Two

It can be hard to imagine yourself 10, 20 or 30 years in the future. But studies show that picturing the things you want to do in retirement—pursuing your passions, learning a new skill or starting a new career—can actually help you do a better job of saving for it. So we asked people to imagine what they want to do in retirement. Then we brought in a bunch of artists to help them picture it—literally.

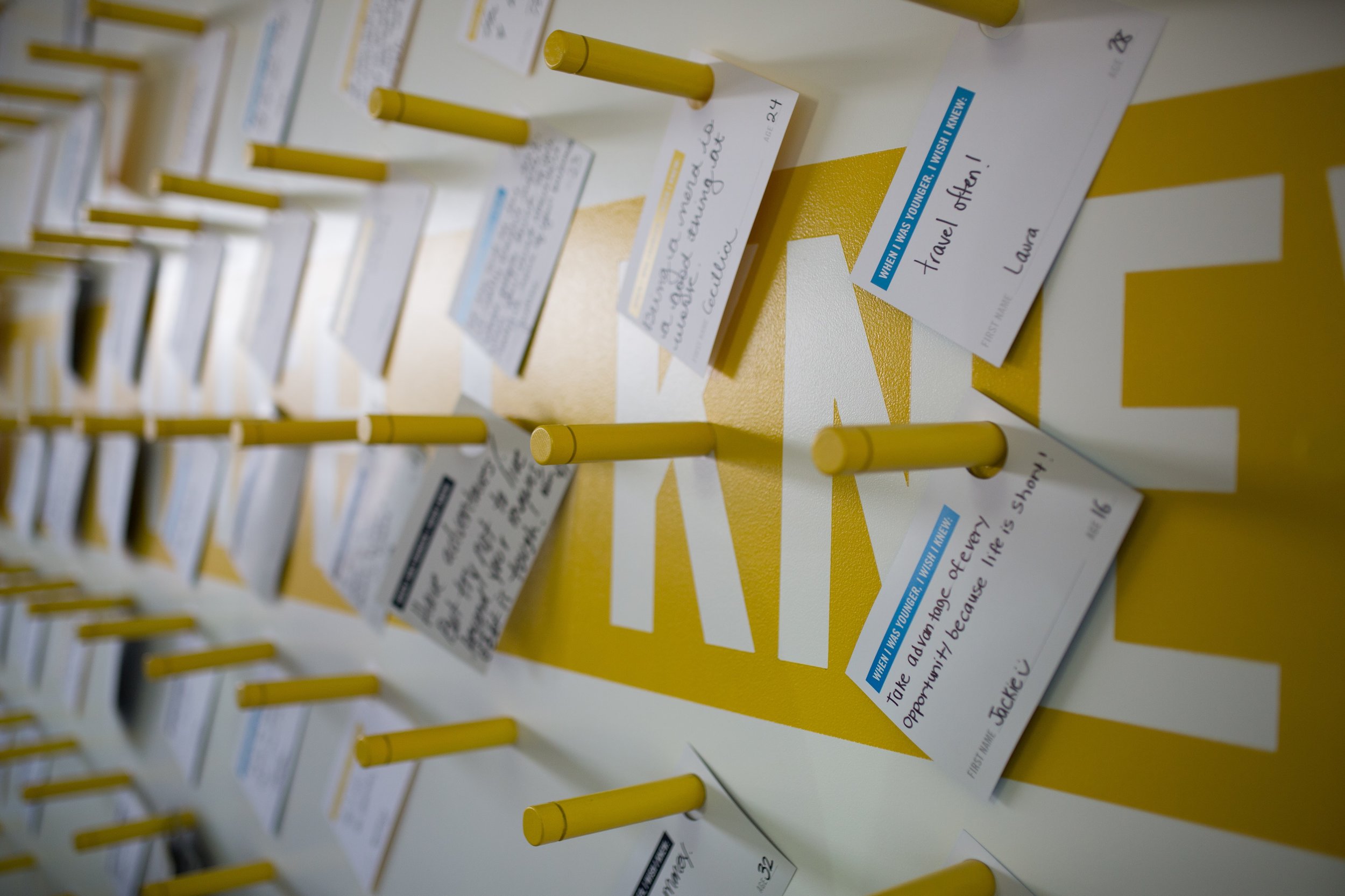

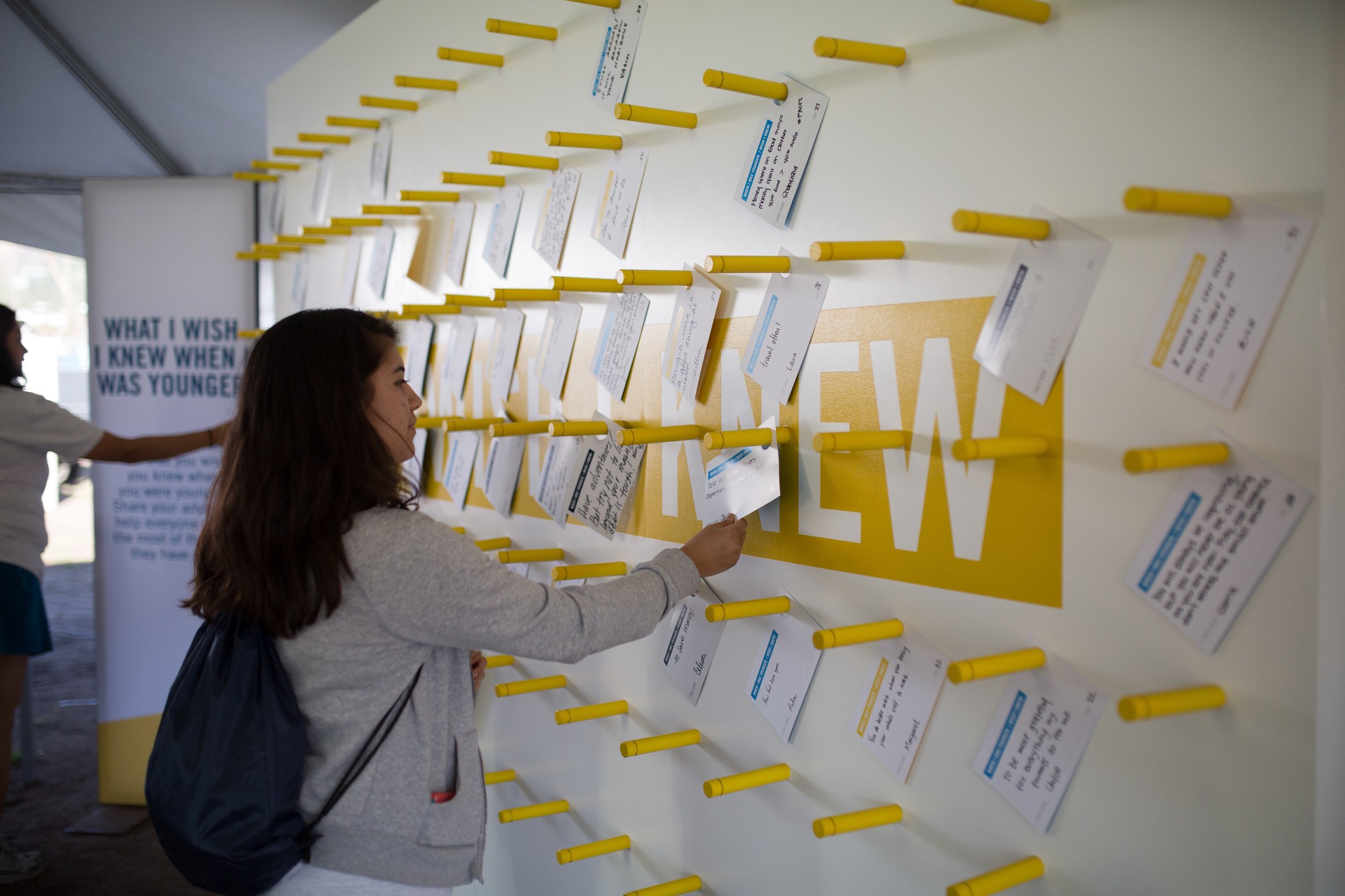

What I Wish I Knew

What do you know now that you wish you knew when you were younger? We created an installation where people could share advice on money, work and life, to help everyone make the most of the time they have now.

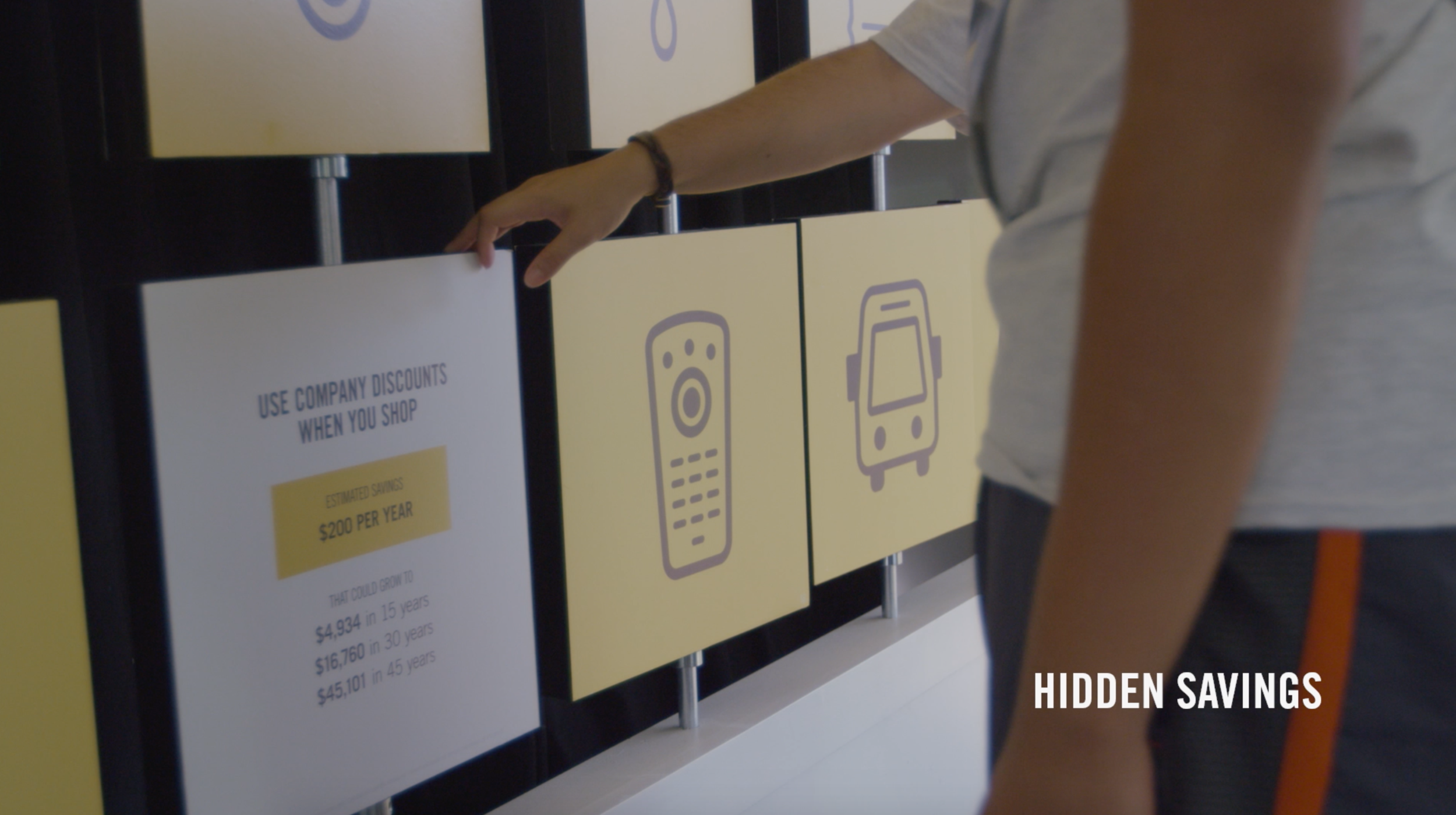

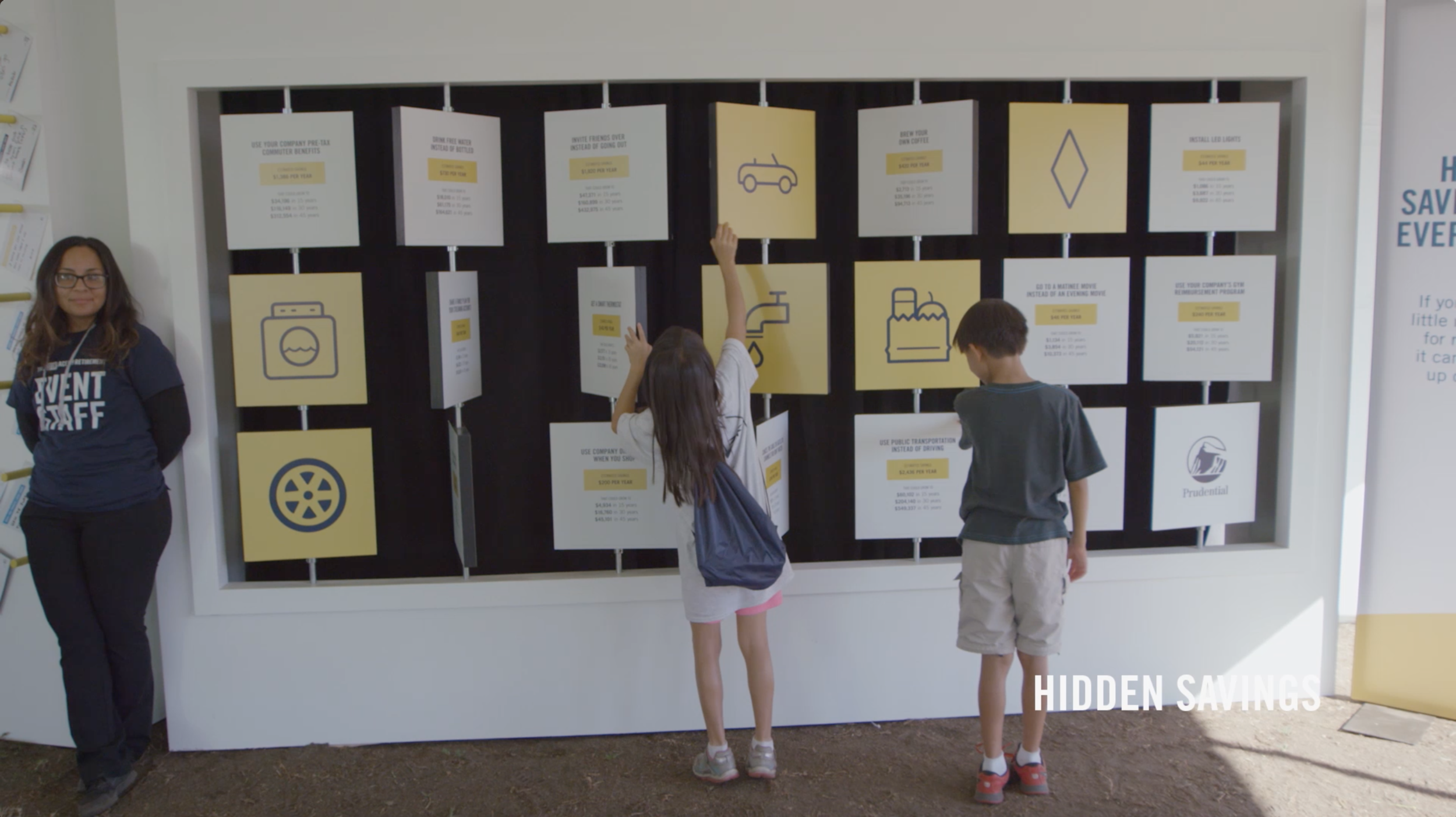

Hidden Savings

Did you know drinking free water instead of bottled could mean $60,000 more in retirement? Washing your clothes in cold water instead of hot could mean another $18,000. And if you bring your lunch one extra day a week, that could be another $30,000. It's easy to feel like you just don't have enough money to save more for retirement. But Hidden Savings are everywhere. So if you just make a few simple changes — use energy saving light bulbs, or brew your own coffee — the savings can really add up over time.

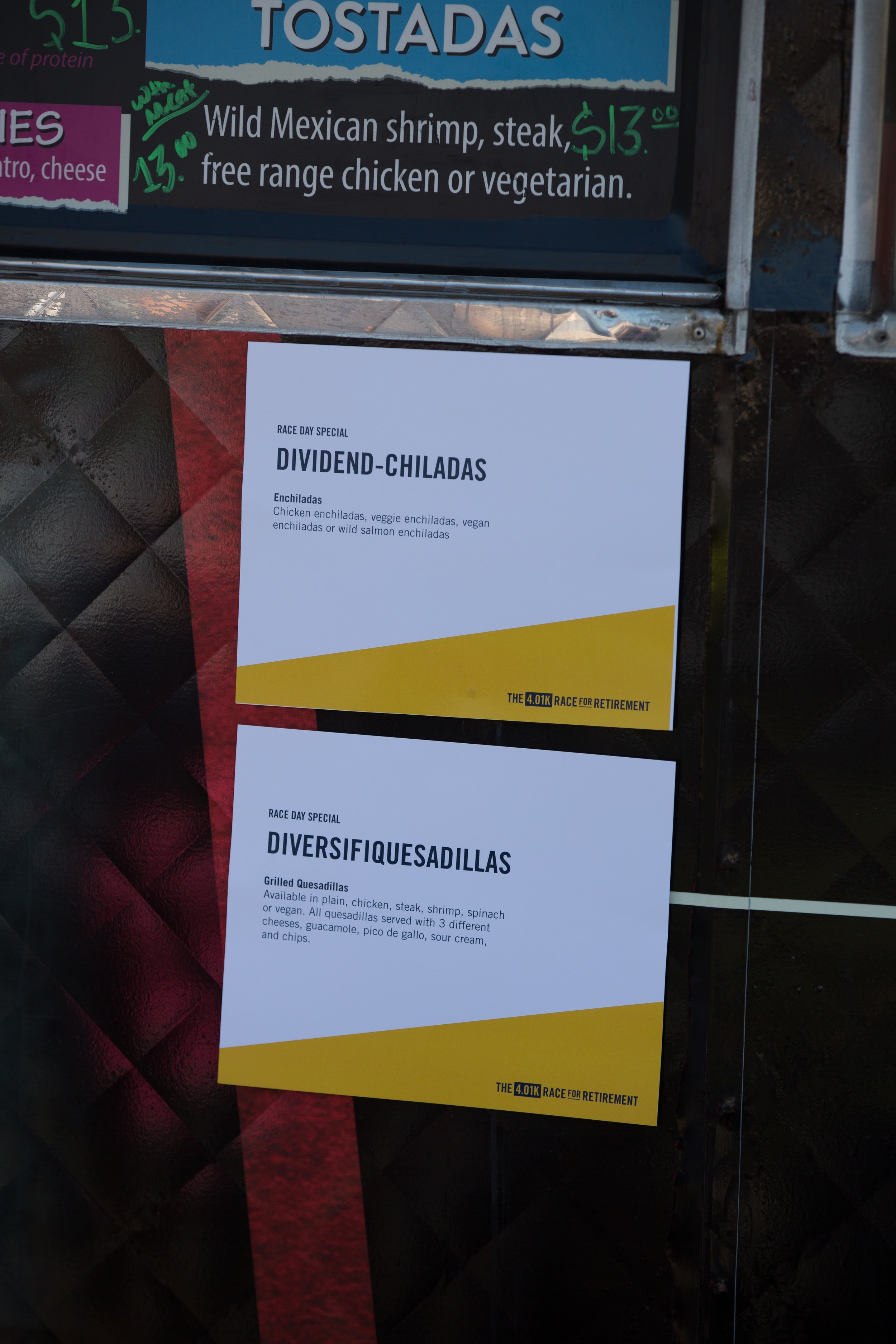

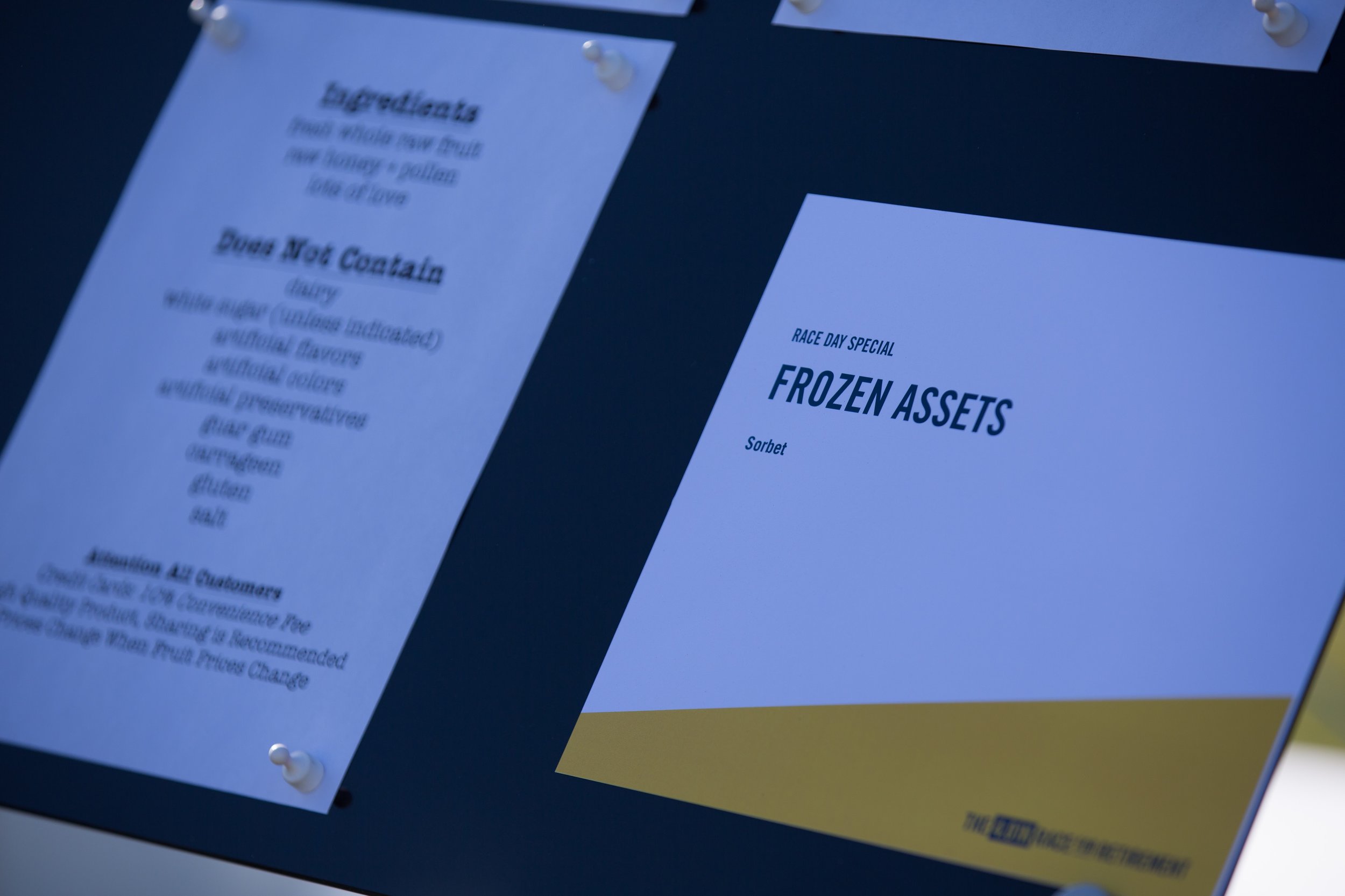

Food Truck Row

We worked with ten food trucks to create some very punny special menu items to get people talking (and smiling) about finance.

GIF to your Retirement

We even had a 180- degree photo booth, so runners could get the word out about saving for retirement — and look like action heroes doing it.

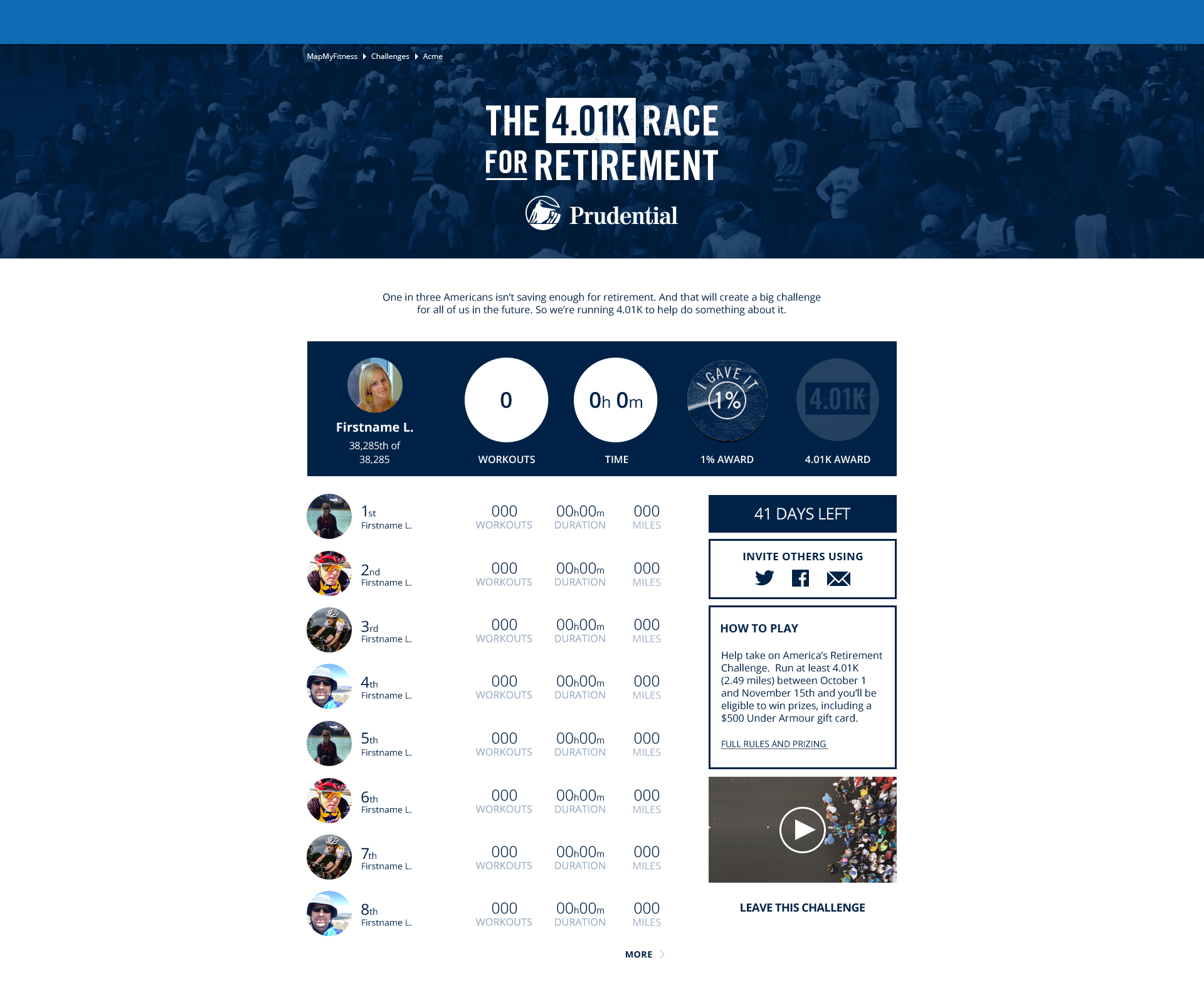

MapMyFitness Partnership

We partnered with running app, MapMyFitness, so people all across America could join in and run their own 4.01Ks. In just two years, more than 150,000 people signed up to run and help spread the word.

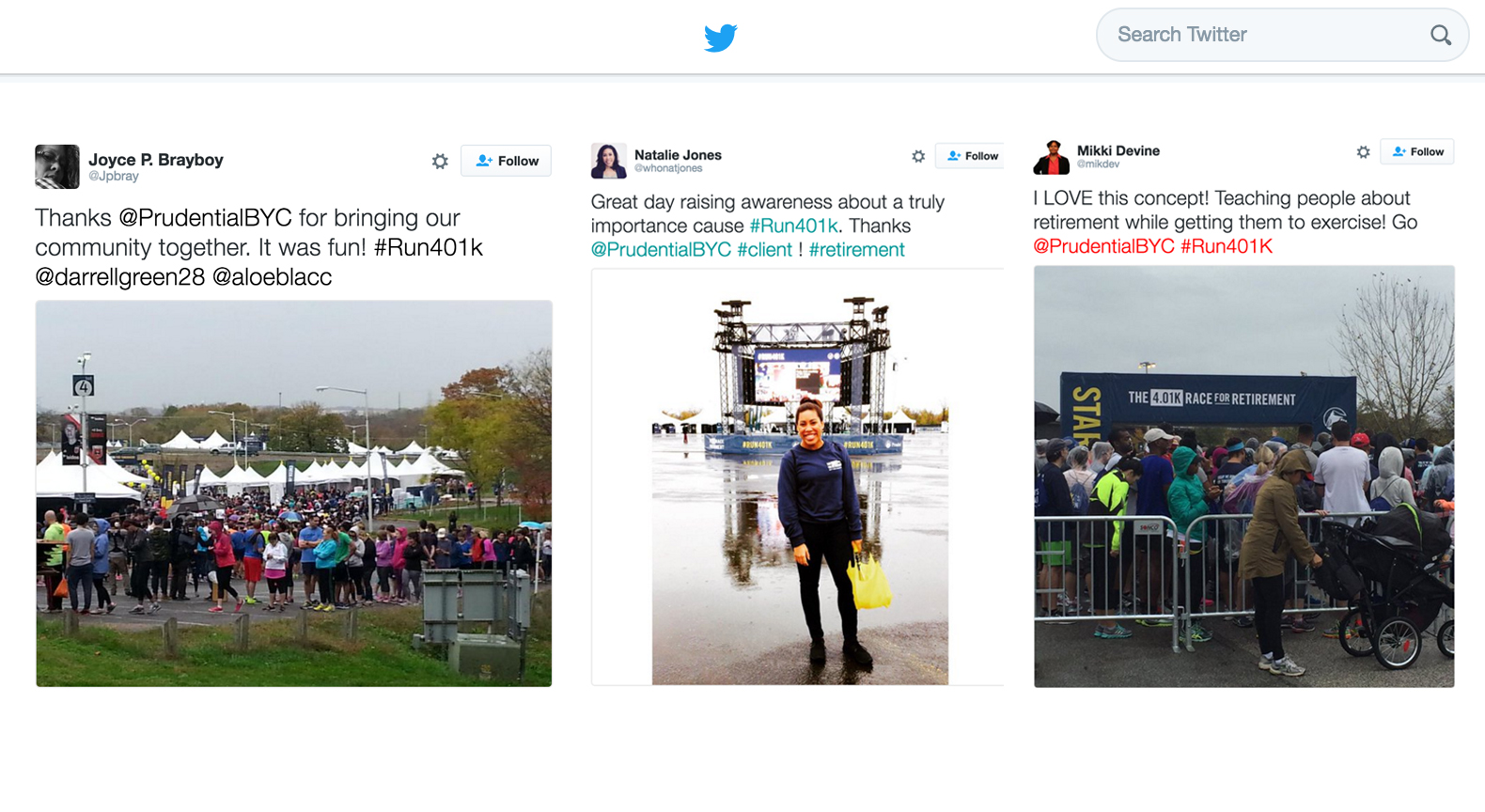

Social response

Documentary: Race for Retirement Stories

Thousands of people came out to run—each with their own personal reasons for raising awareness for the importance of saving. In this two-minute documentary film, we followed the personal stories of three runners from the 2015 race in Washington, DC. They talked about why they ran, and what the race meant to them. The film aired nationally in cinemas.

Runner Recruitment

In two years, more than 25,000 runners signed up to run the 4.01K Race in Washington D.C. and Los Angeles. Generating that much interest took a massive recruitment effort.

Introductory film

We launched registration with this online film, which explained the cause and drove people to register at Run401K.com

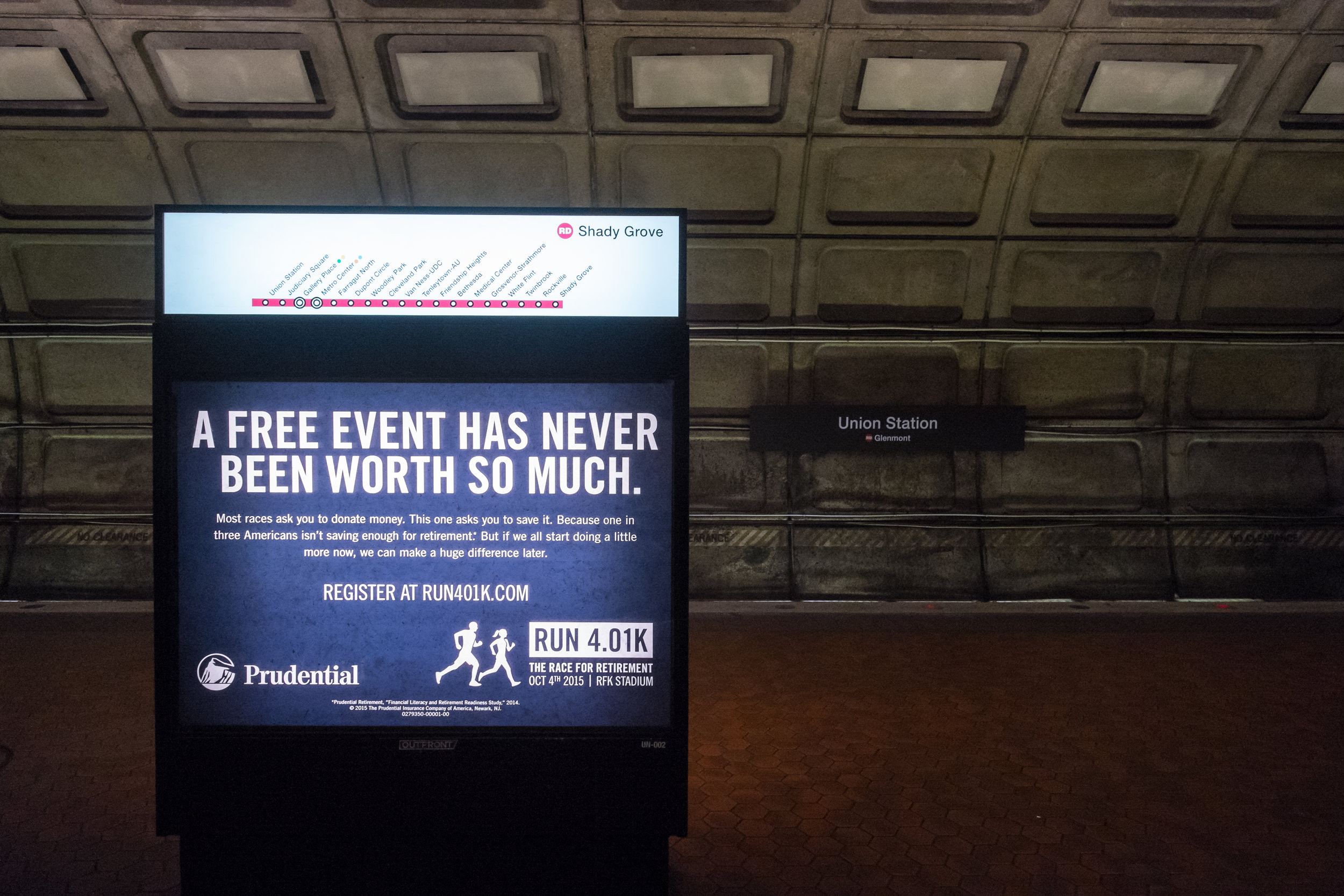

Runner Recruitment: Paid Media

To raise awareness and get people talking about the event, we blanketed the city with out-of-home, online advertising, radio and a station domination at Washington's Union Square Metro station.

Results

In just two years, nearly 200,000 people have run a total of 486,000 miles to raise awareness for America's retirement challenge. That's far enough to circle the globe 19 times.

But they didn't just run. They made a real impact on the retirement crisis. Collectively, their 1% pledges could grow to $2.9 billion in additional retirement savings.

Following the 2015 race in Washington, DC, a post-race study showed that the message didn’t just connect with runners—it resonated throughout the whole Washington, DC, community.

In a study with Washington, DC, residents:

73% said the Race for Retirement raised their awareness of the importance of actively contributing to a retirement plan

20% said they spoke to others about the importance of saving for retirement

10% of said they began contributing to a 401(k) plan

17% said they increased their retirement contributions

20% said they intended to increase their retirement contributions